As a dentist, you know that refining dental scrap is an essential aspect of your practice. It not only helps you recover the precious metals used in dental restorations, but it also helps you reduce waste and increase your bottom line.

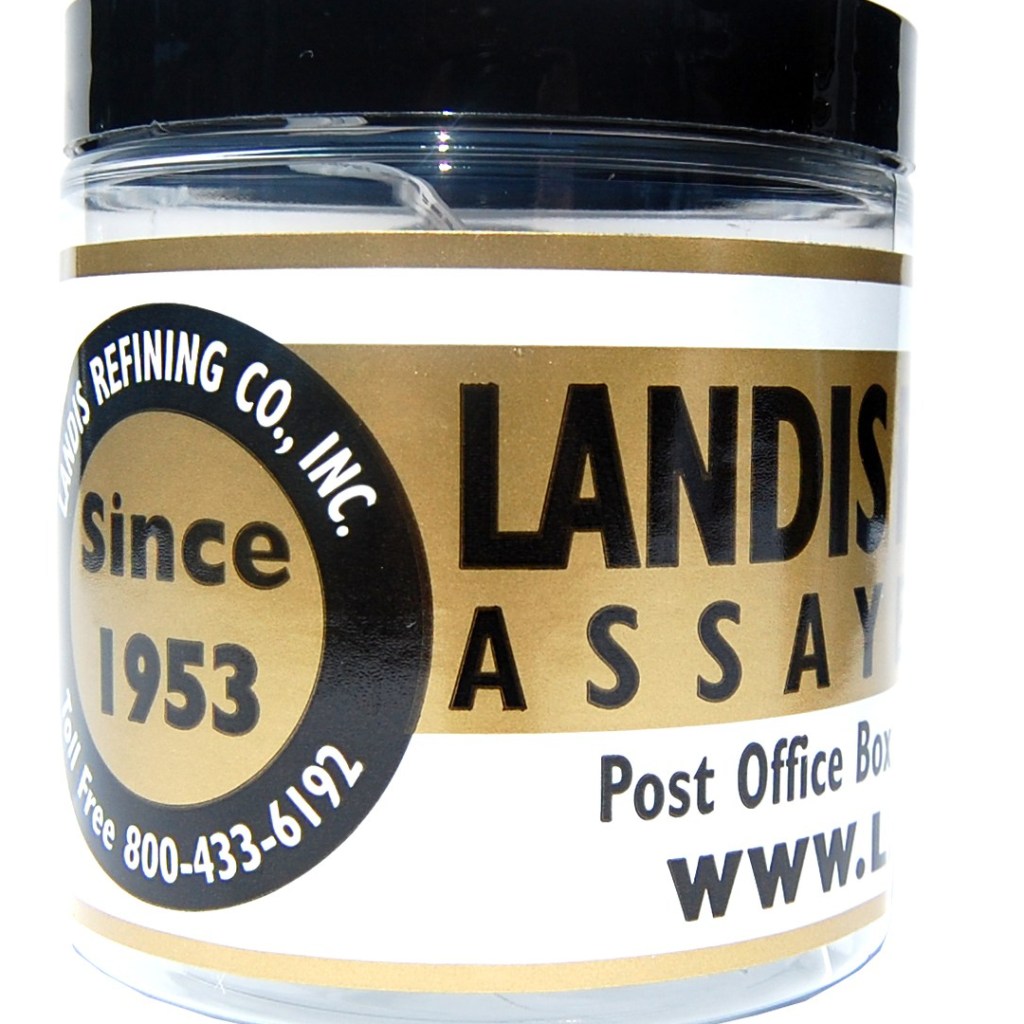

However, not all refining companies are created equal.Our refining company stands out from the competition because of our commitment to excellent customer service and our long-standing reputation in the industry. We have been in business for over 70 years, and we have earned the trust of countless dentists and dental labs over the years.

Our team of experts is highly trained and experienced in refining gold, platinum, and palladium. We use state-of-the-art equipment and the latest techniques to ensure that you get the highest possible yield for your dental scrap. We also offer competitive pricing and quick turnaround times, so you can get your payout as soon as possible.

But what really sets us apart is our dedication to customer service. We understand that you have a lot on your plate, and we want to make the refining process as easy and hassle-free as possible for you. That’s why we offer free shipping and handling, shipment tracking, and quick payouts.

So, why should you choose our refining company over the competition? Because we have the experience, expertise, and commitment to customer service that you need to get the most out of your dental scrap. Don’t settle for less than the best – choose our refining company for all your dental refining needs.

Landis Refining