Viruses are an extremely important component of periodontal disease, both in its initiation and in the ongoing promotion of the attack process. Viruses that initially stem from the mouth also may have much wider systemic impacts.

Several years ago, Jorgen Slots, DDS, PhD, a professor of dentistry at the University of Southern California, reported that herpesviruses [both Epstein-Barr virus type 1 (EBV-1) and human cytomegalovirus (HCMV)] are some of the unrecognized major viruses implicated1 in periodontal attack. Unfortunately, when one transitions from the study of bacteria to consideration of viruses, most dentists cringe, since the profession has the least training in comprehending that submicroscopic world.

Herpesviruses are a leading cause of human viral diseases. There are 9 herpesvirus types known to infect humans: herpes simplex viruses (HSV-1 and HSV-2), varicella-zoster virus (chicken pox and shingles), Epstein-Barr virus (EBV or HHV-4), human cytomegalovirus (HCMV or HHV-5), human herpesvirus (HHV-6A, HHV-6B, and HHV-7), and Kaposi’s sarcoma-associated herpesvirus (KSHV)2.

Ruth F. Itzhaki, PhD, MSc, MA3, demonstrated that the herpes simplex virus type 1 (HSV1), the same virus that causes cold sores in the mouth, is present in the elderly human brain. Once HSV1 infects the epithelial cells of the mucous membranes of the face, it secondarily infects sensory nerve terminals. After it enters the neuron, HSV1 moves to the neuronal cell body in the trigeminal ganglion, located at the base of the skull adjacent to the brain stem.

HSV1 remains in the ganglion in a latent form until reactivation, when the newly synthesized virus is retrograde transported more peripherally4, eventually leading to visible outbreaks such as on the lip. In older subjects, this highly prevalent virus reactivates and enters the brain by way of the peripheral nervous system or the olfactory route5. Though it becomes latent in the brain, it periodically reactivates in association with stressors such as systemic infection and immunosuppression.

Spirochetes, HSV1, Beta Amyloid, and Systemic Diseases

Pathogen-induced inflammation and central nervous system accumulation of beta amyloid (Aβ) (Figure 1) damages the blood-brain barrier, which contributes to the pathophysiology of Alzheimer’s disease (AD)6. Data for both Chlamydophila pneumoniae and spirochetes7,8 shows a high prevalence of these pathogens in AD brains only, suggesting that secondary C pneumoniae and/or spirochete infection of the brain may occur after preliminary HSV1 and other co-factors have already initiated AD pathogenesis9.

|

|

| Figure 2. Amyloid plaques are the hallmark of Alzheimer’s disease. |

Figure 3. The icosahedral capsid in the herpes simplex virus resembles the bacteriophage capsid. |

Since spirochetes can invade all tissues of the body via circulatory pathways10, they may be the instigators of the inflammation that damages the lining of blood vessels and possibly deteriorates the blood brain barrier11. Spirochetes also can take the trigeminal nerve pathway to the brain. Thus, the activation of the already present latent HSV1 by spirochetes in the brain could represent the final step in a series of infections leading to full blown Alzheimer’s disease.

Amyloid plaques, the hallmark of AD, contain fibrillar Aβ (Figure 2). HSV1 has been implicated as a risk factor for AD and found to co-localize within Aβ plaques. Aβ peptides represent anti-infective peptides that protect against neurotropic virus infections such as HSV1 (Figure 3). The Aβ peptide may protect against latent herpes viruses and other infections. This antimicrobial property may explain why Aβ plaque formation plays a pathogenic role in the progression of the sporadic form of AD because it is reacting to an infection12,13.

Very recent research has shown that Aβ plaque in AD is an active biofilm of viable Borrelia spirochetes in Alzheimer’s disease patients. Alan MacDonald, MD, presented compelling evidence from brain tissue harvested from deceased Alzheimer’s patients. In his 37-minute video14, Borrelia Chronic Brain Infections and Development of Alzheimer’s Disease, MacDonald used specific DNA marker probes to ascertain the presence of Borrelia burgdorferi spirochetes (implicated in Lyme disease).

|

|

| Figure 4. There are key differences between a normal prion and the variant folded-over pathogenic form. |

Figure 5. The icosahedral capsid in the bacteriophage resembles the herpes virus capsid. |

According to MacDonald, 100% of the samples tested demonstrated that active biofilms of various forms of Borrelia were enveloped within Aβ. For the first time, MacDonald demonstrated the spore-like role of granular forms of borrelia as viable, virulent pathogens, distinct from the easily recognized spiral corkscrew shaped forms. He identified round body forms of spirochetes in the evolution of AD. All these forms live within active biofilm communities previously characterized as undefined, dead, brown-appearing lesions called Aβ plaques.

Alzheimer’s, Diabetes, and CJD

Growing evidence is showing that diabetes and AD are concurrent entities. Plaques containing fibrillar Aβ deposits associated with dying cells and inflammatory processes are hallmark pathological features in AD and diabetes15,16. The accumulation of Aβ within islet β-cells is a major pathological feature of the pancreas in patients with chronic diabetes.

|

| Figure 6. Bacteriophages inject virus particles into spirochetes. |

Viruses also may be involved Creutzfeldt–Jakob disease (CJD) despite its earlier connection with prion accumulation. CJD is more commonly known as the human form of “mad cow disease” [bovine spongiform encephalopathy (BSE)]. This devastating degenerative neurological disorder is untreatable and inevitably fatal.

CJD is characterized by the presence of a deformed protein called a prion. There is controversy as to how the disease progresses. The explanation most commonly accepted is that a defective prion replicates by converting its properly folded counterparts in the host to the same misfolded structure it possesses, or “prion only theory”17.

However, Laura Manuelidis, MD,18 proposed that virus particles cause CJD.19 Manuelidis claimed that although much work remains to be done, there is a reasonable explanation that viral particles cause the transformation of the prion that is the hallmark of CJD.

It is likely that all the various versions of an abnormal prion are the result of infection by an exogenous and stable viral particle and are a consequence of the neurodegenerative disease process rather than its cause. Abnormal prions are present in extremely small amounts in accessible tissues or body fluids such as blood, urine, saliva, and cerebrospinal fluid20,21.

CJD causes tissue to degenerate rapidly. As the disease destroys the brain, holes in the neural structures develop that resemble a sponge in appearance. Viruses incorporating their DNA elements into the host DNA can reprogram the prion protein synthesis mechanism to produce “mutant” prions.

Prion disease epidemics, which have demonstrated unpredictable recurrence, are of significant concern for animal and human health. Furthermore, chronic wasting disease (CWD) is a relatively new and burgeoning prion epidemic in deer, elk, and moose (members of the cervid family) and may be related to the human prion versions22,23.

This perspective on possible links between CJD and viral pathogens causes us to question if other neurologic diseases causing similar brain damage also may by caused by viruses. AD, multiple sclerosis, autism, Parkinson’s disease, amyotrophic lateral sclerosis, and other neurological entities display similar brain damage.

AD24 is the most common of many neurodegenerative disorders primarily affecting aging humans. Frank Dohler and his colleagues25 reported an investigation that showed an amyloid’s abnormal ability to attract and bind to prions, the same type of molecules that become erratic in BSE and CJD. A normal amyloid is a stacking of normal prions26 (Figure 4).

The main problem in AD is that Aβ formation becomes so prevalent that this material interferes with normal electrical connections in the brain11. Aβ are peptides of 36 to 43 amino acids that are fatefully involved in AD as the main component of the Aβ plaques11.

These peptides result from an amyloid precursor protein (APP) that is altered by certain enzymes to yield Aβ. These molecules can accumulate to form flexible, soluble Aβ fibrils. Abnormal Aβ is a variant binding of a deformed amyloid with folded-over prions, the same malformed, problematic process that exists in BSE and CJD.

It is now believed that certain misfolded abnormal oligomers known as seeds can induce other amyloid molecules to also take on an aberrant, misfolded oligomeric form, leading to a chain reaction akin to an abnormal prion infection.27 The seeds, or the resulting Aβ plaques, interfere with function and are toxic to nerve cells. The other protein implicated in AD, tau protein, also forms prion-like misfolded oligomers, and there is some evidence that misfolded Aβ can induce tau to misfold 32, 28.

In BSE and CJD, as discussed earlier, there is a growing consensus that a virus is encoding prions that are misfolded. If this hypothesis proves to be true, then what is the possibility that the final step of the AD process is also caused by the same virus?

Spirochetes and Viruses

Spirochetes are associated with bacterial viruses called bacteriophages (Figure 5), which are normally lethal to bacteria. Eukaryotic dsDNA viruses (those viruses that replicate only inside the living cells) evolved from bacteriophages. The herpesviruses discussed earlier also evolved from a bacteriophage, but from a different evolutionary root.

Papillomaviruses evolved from single-stranded DNA viruses and ultimately from plastids29. When phages attach to and inject their DNA contents into spirochetes, the cells react differently from other bacteria and are not lysed by the bacteriophage30.

Instead, researchers realized that they could use these bacteria viruses as research tools31 to alter spirochetal DNA. Bacteriophages were used to inject virus DNA into spirochetes to increase their virulence, such as antibiotic resistance. The Borrelia burgdorferi spirochete is an alleged example of this potentially weaponizing alteration32. Bacteriophages have also been isolated in dental plaque33.

Spirochetes contain plastids, which are small linear or circular extra-chromosomal DNA. These packages can be transferred between other species’ spirochetes and to other bacteria as well in a process called transduction. Since bacteriophages and plastids are intimately associated with spirochetes (Figure 6), it would not be much of a stretch to speculate that the herpesviruses are also associated with spirochetes since all three are so closely related to each other in their evolutionary tree.

Spirochetes can transport these viruses by disseminating them to distant organs, further substantiating their potential importance in oral and linked systemic disease. Thus, it is possible that spirochetes serve as a rich source of transferable genetic material to remote locations of the body. Since many spirochetal diseases produce neurological symptoms34, such as syphilis and Lyme disease, further research is needed to evaluate whether herpesviruses or viral particles carried by spirochetes to the brain are associated with alteration of prions and Aβ.

Read more via Protect Your Patients and Practice from Prions, Viruses, and Systemic Disease | Dentistry Today

Follow us on Instagram

Like us on Facebook

SHARE

SHARE

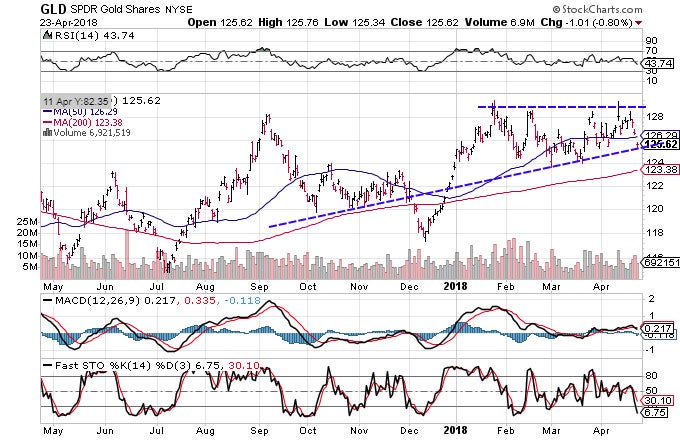

LONDON — The five banks that settle every transaction in London’s $6.8 trillion (4.9 trillion pounds) a year gold market are changing the rules of their clearing house to make it easier for newcomers to join.

LONDON — The five banks that settle every transaction in London’s $6.8 trillion (4.9 trillion pounds) a year gold market are changing the rules of their clearing house to make it easier for newcomers to join.

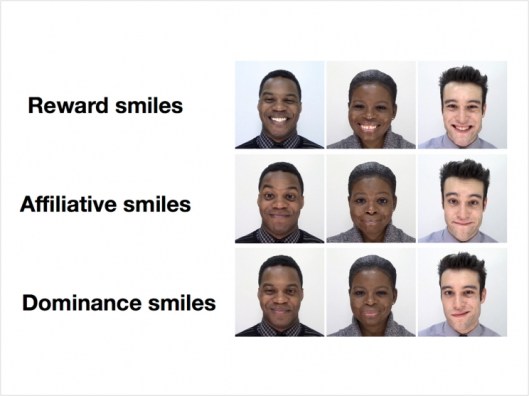

Different kinds of smiles provoke different kinds of biological responses in the people who see them, according the

Different kinds of smiles provoke different kinds of biological responses in the people who see them, according the